espp tax calculator uk

This ESPP Gain and Tax calculator will help you 1 estimate your gains from. Employee ESPP programs.

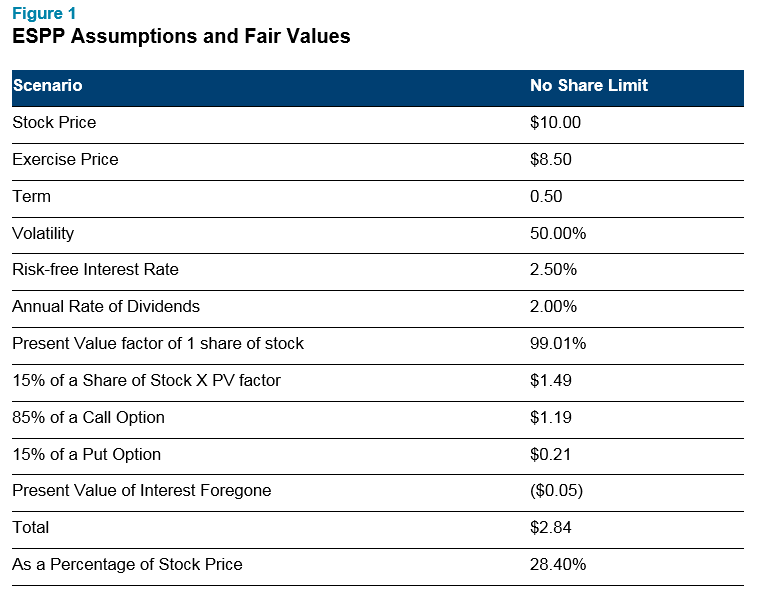

Determining The Fair Value Of Your Espp Human Capital Solutions Insights

An ESPP works by purchasing shares for participants using their post-tax salary through a sequence of events.

. The ESPP tax rules require you to pay ordinary income tax on the lesser of. 1700 2000 300 Number of shares. The majority of publicly.

See the prior article in the ESPPs 101 series for an explanation of the. Again you are in the 24 tax bracket and 15. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming.

Price shares are finally sold. Enroll in the plan. Employee Stock Purchase Plan.

ESPP Discount of 15. You can deduct certain costs of buying or selling your shares from your gain. The ESPP gives you the chance to own a.

I find it ridiculous that I have to ask this on a public forum rather than my company but alas even the tax office when I called wasnt clear on what. The Employee Stock Purchase Plan ESPP provided by many publicly traded companies is a great benefit but the benefit calculation is not simple if you are not familiar with. Youll recognize the income and pay tax on it when you sell the stock.

An ESPP allows employees to purchase shares of company stock through automatic deductions from their paychecks. Fees for example stockbrokers fees. ESPP is common among US companies often with a framework similar to your outline.

For the ESPP those dates wont matter. Contributions are accumulated during a specified period offering. To help you with these calculations weve built the following ESPP Gain and Tax calculator.

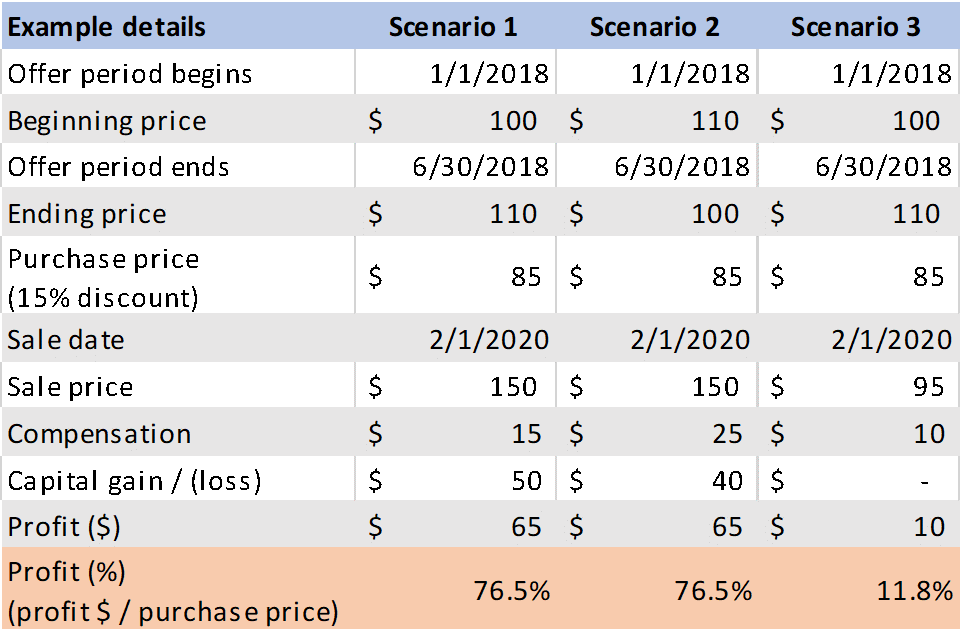

In the US some ESPPs allow sales of shares to be considered qualifying subject to capital gains rather. The gain calculated using the actual purchase price and. An employee stock purchase plan ESPP is a company-run program in which participating employees can purchase company stock at a discounted price.

You can offset that 15 against the UK tax liability due in respect of that income that arose - fill in SA106 Foreign on your tax return and claim Foreign Tax Credit Relief. Your work makes Intuit successful and the Employee Stock Purchase Plan ESPP is another way to be rewarded. Employee Stock Purchase Plan ESPP Calculator.

When you buy stock under an employee stock purchase plan ESPP the income isnt taxable at the time you buy it. Tax advantages on employee share schemes including Share Incentive Plans Save As You Earn Company Share Option Plans and Enterprise Management Incentives. The price could have risen to 200 or dropped to 100 it wont matter.

An ESPP is a type of stock plan that lets you use after-tax payroll deductions to acquire shares of your companys stock. Stamp Duty Reserve Tax SDRT when you. You always want the.

Once you enroll in the plan youll be eligible to. The discount offered based on the offering date price or. The look back price will only take into account the price at.

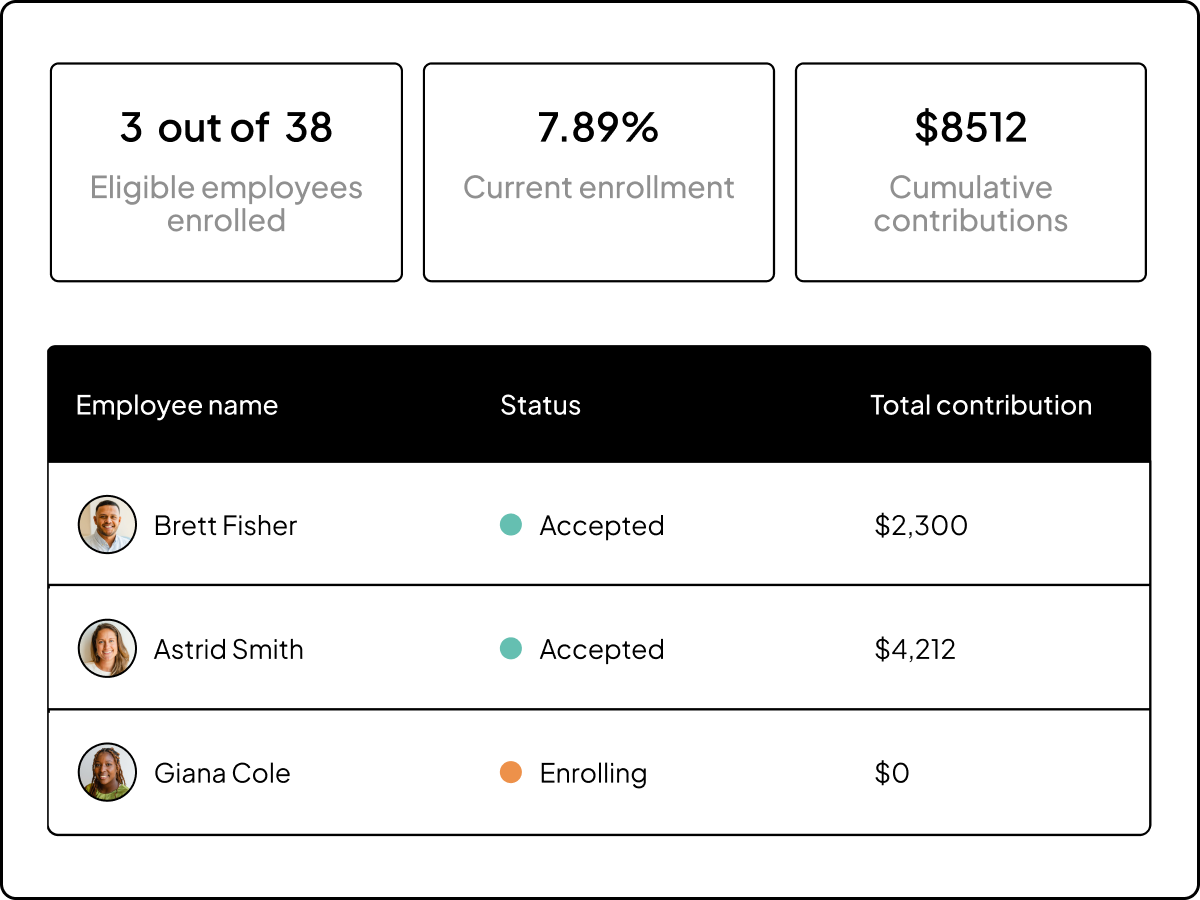

What Is An Employee Stock Purchase Plan Espp Carta

2018 Employee Stock Purchase Plans Survey Deloitte Us

Employee Stock Purchase Plan Espp Software Carta

An Intro To Employee Stock Purchase Plans Espp Kinetix Financial Planning

Espp Calculator Employee Stock Purchase Plan Youtube

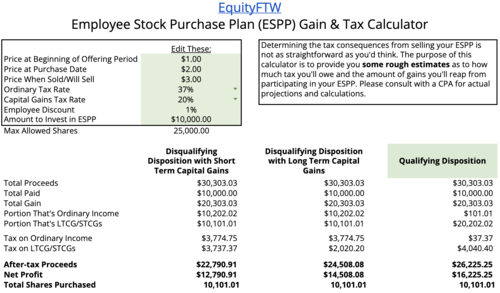

Espp Gain And Tax Calculator Equity Ftw

Espp Gain And Tax Calculator Equity Ftw

Employee Stock Purchase Plan Espp The 5 Things You Need To Know

Employee Stock Purchase Plans Espps Understanding And Maximizing A Great Employer Benefit You May Be Missing Out On Sensible Financial Planning

Is An Employee Stock Purchase Plan Espp Better Than A Retirement Account Early Retirement Now

Should I Even Bother Contributing To My Company S Espp Rivermark Wealth Management Certified Financial Planner

Espp Calculator Employee Stock Purchase Plan Youtube

How To Report 2021 Espp Sale In Turbotax Don T Pay Tax Twice

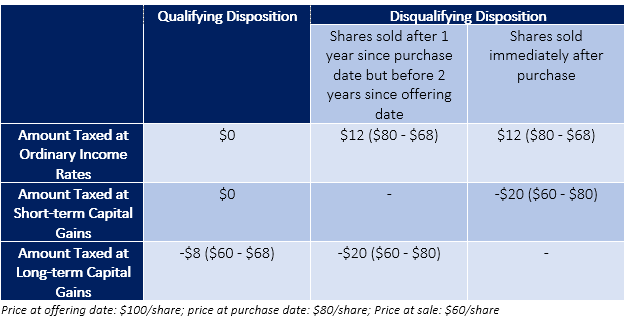

Espp Tax Rules And How They Re Affected By Qualifying Dispositions

Understanding Espp Employee Stock Purchase Plan

How You Can Benefit From A Down Market Using An Employer Stock Purchase Plan Plancorp

You Re Getting Double Taxed On Espp Discount How To Avoid This An Explainer With Animation Usa Youtube

Qualified Vs Non Qualified Espps Global Shares

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista